We are all familiar with the exponential rise in the stock market

over the past 100 years. However, less commonly known is that within

that rise has been a rather predictable cycle of 35year with distinct

peaks and troughs.

|

| Figure 1: The 35 year stock market cycle with a

sine-wave to help guide the eye. This S&P500 / US GDP ratio can be

considered to be akin to a macro version of the price / sales ratio for the US economy. |

By normalizing the S&P 500 index to the US GDP, the 35

year cycle becomes plainly obvious as shown in the above figure. When

the ratio is rising into the peaks, the stock market in general

outperforms the US economy and when it descends into the troughs, it

underperforms. Or considering it from another perspective, the ratio is akin to a

macro version of the

price/sales ratio for the US stock market. Either way one looks at it, the best buying opportunity is when the cycle is low. Others, including Warren Buffett in a

Fortune article in 1999, have noted this peculiar cyclical feature of the stock market

when talking about the two 17 year periods of outperformance and

underperformance.

Since the market peak in 2000, we have remained in the

underperformance portion of the cycle which does not reach its cycle

bottom until mid-2017. Despite the QE fueled counter-cycle run-up in

stocks that we have seen as of late, one should heed caution as this

cycle chart suggest that the period of underperformance is not over

with. Considering that the GDP tends to be the slower moving of the two,

one can assume that it is the value of the S&P500 that will be the

dominant influence in pushing the ratio down. Incidentally, Charles

Nenner, a cycle expert, is also

predicting a major stock market crash around a similar time frame, 2018 - 2020.

One

can analyze the implication of this cycle low further by considering a

log plot of the S&P500 index and its residual (i.e. the difference

between the actual S&P500 value and its trendline expressed in %

terms). Within the residual, we also can make out the 35 year cycle as

well as identify that during the previous two cycle lows, (mid-1940s)

and (late-1970's to early-1980s), the S&P500 was down 50% from its

trendline. (Please see the arrows pointing to this on the residual

line.) If history were to repeat again the chart would suggest the

S&P500 bottoming out between 1000 - 1200 on the monthly chart during

the upcoming cycle low. On this point, Charles Nenner is suggesting a

low for the DOW of 5000 during the 2020 low which would imply an

S&P500 of around 600 or down 75% from the trendline; an outcome that

would be without precedent based on this chart. Another thing to note

from here is the "bubble" prices in the S&P500, both in 1929 and

2000, become clearly evident as the index deviates over 100% above the

trendline.

|

| Figure 2 : S&P500 and its trendline. |

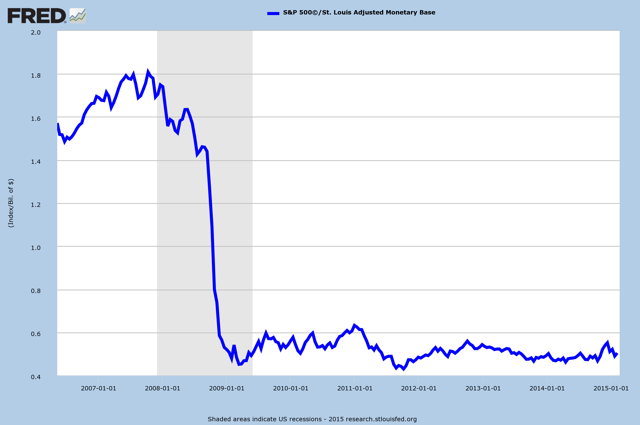

One possible flaw with this S&P500 price-target analysis is it implicitly assumes a linear projection into the future which could be thrown off due to the radical monetary policy currently underway with quantitative easing (QE). Granted, that linear projection has held for the past 87 year (from 1928 - 2015) despite the ups and downs of both the monetary base and the S&P500, however, if one looks at the S&P500 to US monetary base ratio, Figure 3, it suggests two things: (a) the ratio is already at or close to a cyclical low and (b) since the ratio has flat-lined since 2009, the stock market is tracking 1:1 with increases in the monetary base. One possible interpretation of this is the stock market will be range-bound, within the confines of this ratio, for the balance of the decade. However, if this turns out to be the case it would also have to imply that the nominal GDP in the US will increase substantially, 20% annually, to get the stock market cycle ratio, from Figure 1, down to its cycle low. Most of this nominal GDP increase would likely have to be derived from the inflation component as real GDP growth of this magnitude would be practically impossible. However, even nominal growth at that level seems highly unlikely.

Regardless of the interpretation though, the implication remains the same that the S&P500 index's upside will likely be limited.

|

| Figure 3: The ratio of the S&P500 to the US monetary base indicates we are already at a cycle low and it has essentially flat-lined since 2009. |

If

one is of the opinion that the S&P500 will play out as suggested by

the 35 year stock market cycle, then what would be one's best course of action as no

easy mechanism exists to go long US GDP and short the US stock market.

Incidentally, this 35 year cycle period also manifests itself in the

stock market to gold price ratio as seen in the figure below. Not only

that, but it is more leveraged to the cycle than the stock to GDP ratio

by a factor of 8x.

|

| Figure 4: Gold to S&P500 cycle |

By

starting with the adage, 'gold is money', one can attempt to extract

future price targets for gold from a monetary point of view. Assuming

that the 'model' price of gold proportionately tracks changes in the US

monetary base starting in 1934 when gold was officially revalued to

$35/oz and further discounting that 'model' price by 1.5% annually to

account for added gold supply from mining production then the implied

'model' price today would be $5,500/oz. Turning ones attention to the

residual (i.e. the difference between the 'model' price and the actual

price of gold) one can see the bubble prices clearly standing out as it

did in 1980 when the actual price exceeded the 'model' price by 140%. In

comparison, in 2011 when the gold price touched $1,923 to form a local

maxima, it was still at a discount to the model price and thus not indicative of a bubble. If we were to get similar bubble again in gold price today, i.e.

greater than 100% above the model price, then it would suggest gold

trading at greater than $10,000 per oz.

|

| Figure 5: Gold model-price based on a proportionate increase with the US monetary base compared to the actual price of gold. |

Lastly,

further insights can be gained by looking at the monetary base itself.

From 1919 - 2008, the US monetary base increased at an annualized rate

of 6.9% which is roughly equivalent to that of the S&P500 rate of

6.7% (as seen the prior chart). This suggests that on average, the

capital gains realized on long-term investments in the broader stock

market match precisely the amount of money-inflation that has occurred

over that period of time. In other words, backing out money-inflation,

in real terms one is only getting the roughly 2% return from dividends.

|

| Figure 6: US monetary base and its residual. |

Conclusion:

The analysis above makes the case that the broader markets, represented by the S&P500 Index, has limited upside or the potential to be significantly lower in the 2017-2020 time frame. In contrast, gold and other precious metal investments in general are likely to be significantly higher. After the

2017 - 2020 low is reached, going long stocks would be appropriate as

the next upswing in the 35 year cycle begins and would last until the

next cycle peak is reached in the year 2035.