There is a

good article

by Mervyn King, then Deputy Governor and subsequently Governor of the

Bank of England, published in 2001 that is very pertinent to today's

quantitative easing (QE) program and its consequences in time.

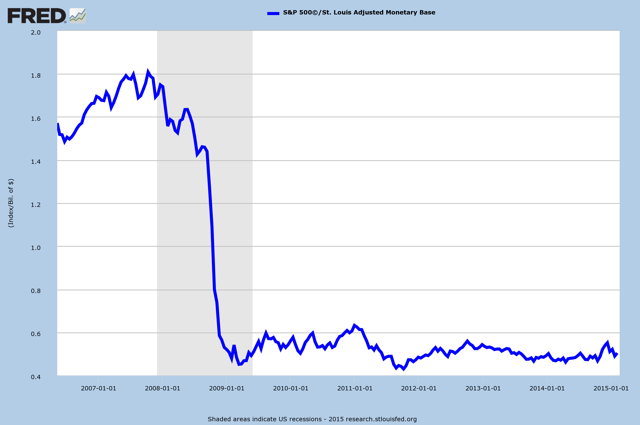

Specifically, in Chart 1 he shows rather convincingly that expansions in

the money supply, with an appropriate lag, will lead to an

proportionate increase in consumer price inflation with a 99%

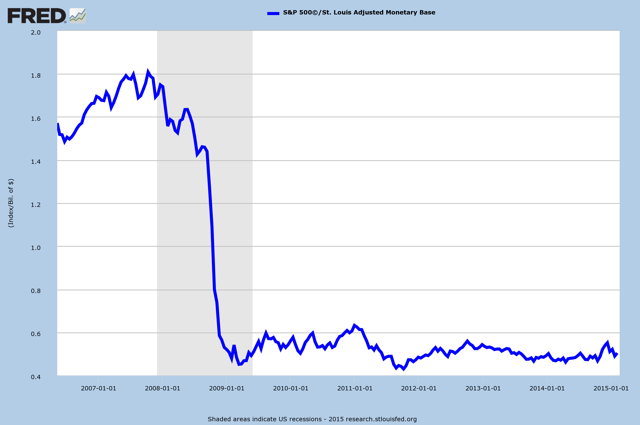

correlation. With today's QE program, we already see 1-to-1 correlation

between increases in the monetary base and assets prices, particularly

stock prices as seen in Chart 2 where the ratio of the S&P500 index /

US monetary base has flat-lined since 2009. In other words, the strong

growth we have seen as of late in the US stock market is being equally

offset by the growth in the monetary base. This increase in the

S&P500 index can be dubbed in general, asset inflation, and

financial assets such as stocks tend to be among the first things

'bid-up' in price due to an expansion in the money supply. And as clear

as day turns to night, with an appropriate lag, eventually that asset

price inflation will spread into consumer prices and formally enter the

'inflation' metrics as commonly computed; the CPI.

|

| Chart 1 : Money growth shows a 99% correlation to consumer inflation with an appropriate time lag. |

The stated objective by central banks for engaging in these QE money

expansion programs is to stimulate the economy. However, again thanks to

Mervyn King, Chart 3 in his paper blows a hole in this stated

objective. As can be seen below, there is no correlation (-0.09) between

money growth and real GDP output growth. In other words, the historical

data refutes the idea that money expansion will stimulate the economy

in real terms. So behind the talk, what is the real reason why QE is

being used so aggressively? It seems to be for the purpose of creating

asset price inflation in order to avoid governments, banks, and central

banks fear of

asset price deflation. In hard core asset price

deflation, particularly for assets that are collateralized and debt

financed, they could end up on the banks balance sheet and their

deflating value could lead to individual and system-wide bank failures.

For government, their inflation tax does not work during deflation. For

example, if nominal asset prices increase 100% after 5yrs, that gain can

be taxed even though say in real terms (inflation adjusted) the price

is still the same. In a deflationary world, if asset prices fall 50% in

nominal terms, the holder of that asset can get a tax benefit by taking a

tax loss even if in real terms the price had not changed. Without

inflation, a large portion of a government's effective tax revenue would

go into reverse. The last reason for QE has to do with decreasing the

relative value of the 'unit of account', i.e. the US dollar. By doing so

the effective level of debt can be decrease without formally defaulting

on it. In the common vernacular, this has been called inflating ones

debt away.

|

| Chart 2 : Ratio of the S&P500 / US monetary base |

|

| Chart 3: Money growth shows no correlation with real output growth. |

No comments:

Post a Comment